July 2024 Alberta Real Estate Remains Solid With Edmonton Booming

Categories

Recent Posts

August-2024-Market-Update

Should you Renovate before selling? & Budget-Friendly Home Renovation & Repair Ideas

Cap Rates Vs. Interest Rates - 'Negative Leverage?'

Renovation, But No Permits!

Door Blog

July 2024 Central Alberta Market

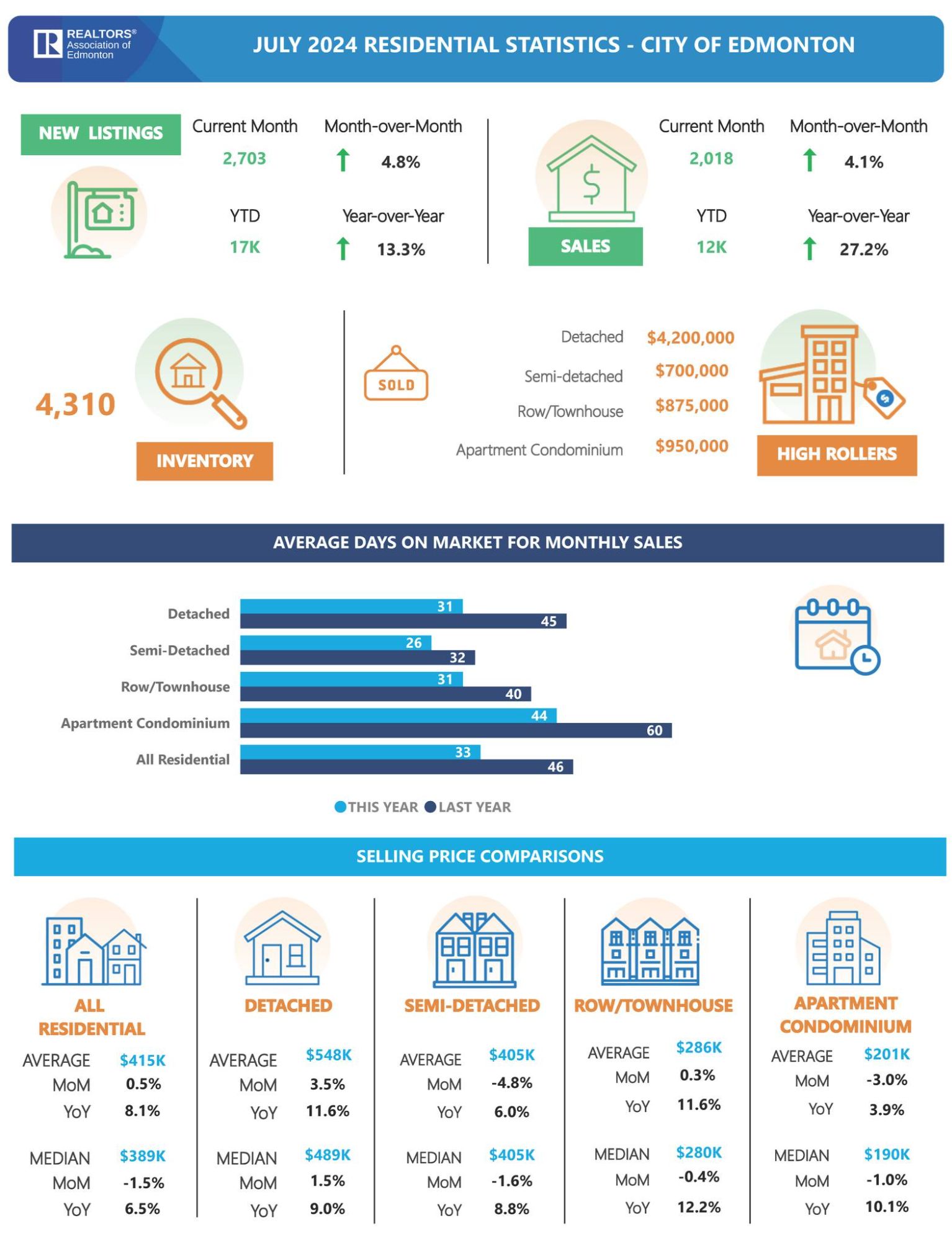

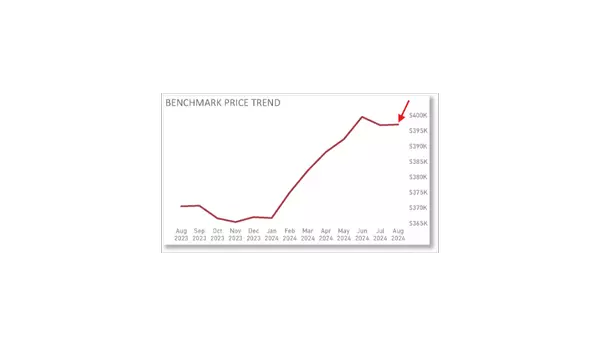

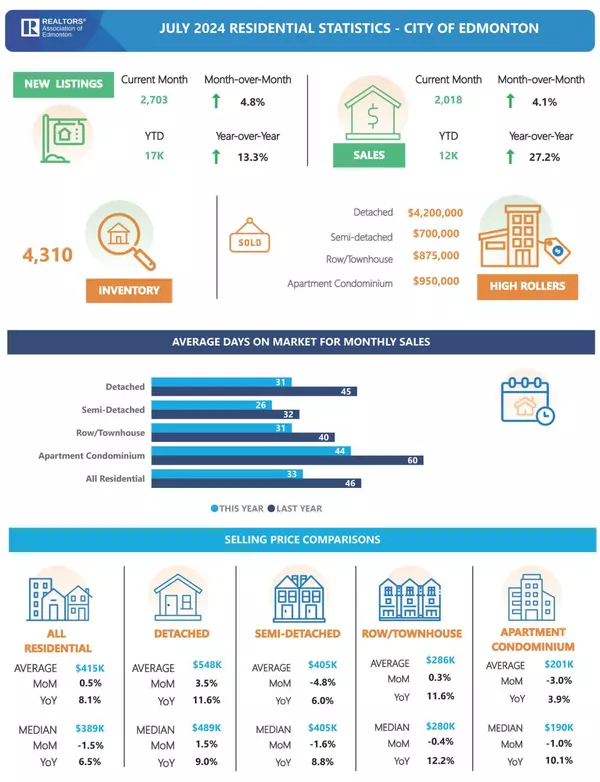

July 2024 Alberta Real Estate Remains Solid With Edmonton Booming

June 2024 Edmonton's Market Update

Why use a Real Estate Agent?

The Home Buying Process

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "

Unit 1400 - 10665 Jasper Ave, Edmonton, Alberta, T6N1M2, CAN