August-2024-Market-Update

Here's the latest for Edmonton!

Mortgage News

The BoC has cut it’s rate by a further 25 basis points just recently on September 4, making it a third consecutive move to bring rates lower.

This means its trendsetting rate now sits at 4.25%.

What does this mean for all of us?

Variable rate mortgages will feel this change more significantly.

For every $100,000 of a variable rate mortgage the 25 basis points or .25% reduces your payments by about $15 per month.

Looking ahead, Economists are predicting that by the end of next year we are hoping to get the BoC interest rate down to about 3-4%. Interest rates are expected to drop, but don’t get too excited – that doesn’t mean mortgage rates will fall as much.

If you are getting a new mortgage, consider locking it in for a short term and renewing at hopefully what will be a lower rate in the next year or two, however this could mean a higher interest rate for short terms mortgages,

talk to your mortgage broker to see if there is a cost / benefit for you if you are hoping to take advantage of the lower rates.

The decision is a further indication of the Bank’s confidence that inflation and the overall economy have cooled enough to justify lowering borrowing costs, with Canadians on variable-rate mortgages and those with home equity lines of credit (HELOCs) set to see their rates fall again.

The Bank will meet on interest rates twice more in 2024, October 23 meeting to be followed by its final decision of the year on December 11.

Edmonton Real Estate

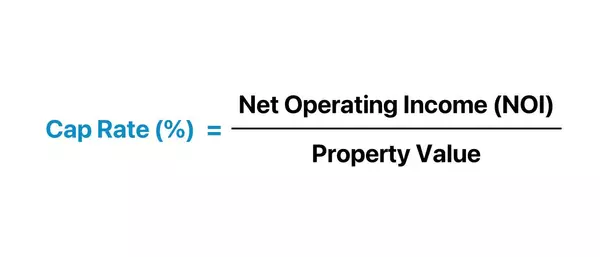

The amount of new listings in the Edmonton area has decreased for the month of August which is down 5% from last month but up 10% from last year.

Sales are also down by 11% from last month and up almost 12% from last year.

Months of Inventory: 2.4 months of inventory if there are no new listings and with the rate at which properties are selling. This has the been the lowest it's been in a long time for the month of August.

Edmonton average days on the market before a listing is sold is 27 days, close to a month on market before it is sold.

In comparison to the previous 2 years this was a decrease from 40 days (almost a month and a half).

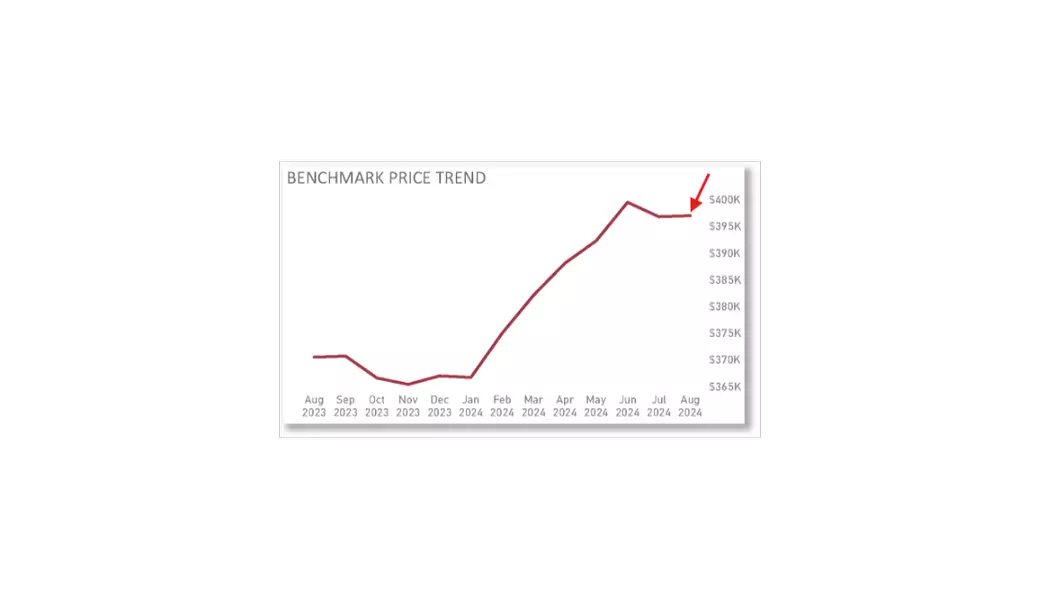

Median Sale price - $389,500 which is up from $360,000 from last year.

Sales to new listings ratio is 71% meaning that there are 71% sales to the amount of new listings on the market for the month of August indicating a Seller’s market.

Calgary vs. Edmonton:

Calgary has seen significant population growth, with 96,000 people added in one year, resulting in a strong housing market.

Edmonton has also grown, but at a slower pace than Calgary. However, Edmonton is starting to see a pick-up in housing prices, possibly narrowing the price gap with Calgary.

The gap between Calgary and Edmonton housing prices is near a record high, but Edmonton’s market is showing signs of catching up.

Here’s a positive for Edmonton, As cities like Calgary get more expensive, more people might start looking at more affordable options like Edmonton.

Alberta’s housing market is booming!

As it was with most of 2024 there’s been an overwhelming low supply and high demand mostly facilitated by rapid population growth in Alberta, especially from interprovincial migration from Ontario and BC with people looking for more affordable housing.

Alberta’s builders are keeping up, and that’s why housing starts here are outpacing the rest of Canada. But even in Alberta, cities like Calgary are getting pricier, which could lead more people to start looking at more affordable spots like Edmonton.

The population in Alberta is growing faster than the rest of Canada, with more housing starts to accommodate the influx.

Alberta’s affordability relative to other provinces is a significant driver of interprovincial migration.

But here’s the kicker: even though Alberta is seeing a lot of growth, the Canadian economy overall is struggling. Higher interest rates are hitting consumers hard, and many are cutting back on spending

Future Outlook:

· Alberta is expected to continue its strong population growth due to its younger demographic and economic opportunities.

· The province will face challenges in meeting housing demand and ensuring sufficient skilled labor for construction and major projects.

The Big Picture:

· Despite Alberta’s growth, the overall Canadian economy is struggling with high interest rates, leading consumers to cut back on spending.

· Both the Bank of Canada and the US Federal Reserve have been managing interest rates to control inflation.

· The Bank of Canada has shifted to a more cautious approach, indicating potential interest rate cuts as inflation trends downward.

The real question is, will Alberta keep booming? With the Trans Mountain pipeline and other big projects in the works, Alberta's economy is set to stay strong, especially in energy and construction.

Conclusion

The Alberta housing market is expected to stay strong, making it a good time to consider buying a home before prices rise further.o Alberta is outperforming the rest of Canada in economic growth due to its strong energy sector and population growth.So, what does all this mean for you? If you’re in Alberta, expect the housing market to stay hot, and keep an eye on those interest rates. And if you’re thinking about buying a home, now might be a good time to get in before prices climb even higher.

Categories

Recent Posts

August-2024-Market-Update

Should you Renovate before selling? & Budget-Friendly Home Renovation & Repair Ideas

Cap Rates Vs. Interest Rates - 'Negative Leverage?'

Renovation, But No Permits!

Door Blog

July 2024 Central Alberta Market

July 2024 Alberta Real Estate Remains Solid With Edmonton Booming

June 2024 Edmonton's Market Update

Why use a Real Estate Agent?

The Home Buying Process

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "

Unit 1400 - 10665 Jasper Ave, Edmonton, Alberta, T6N1M2, CAN